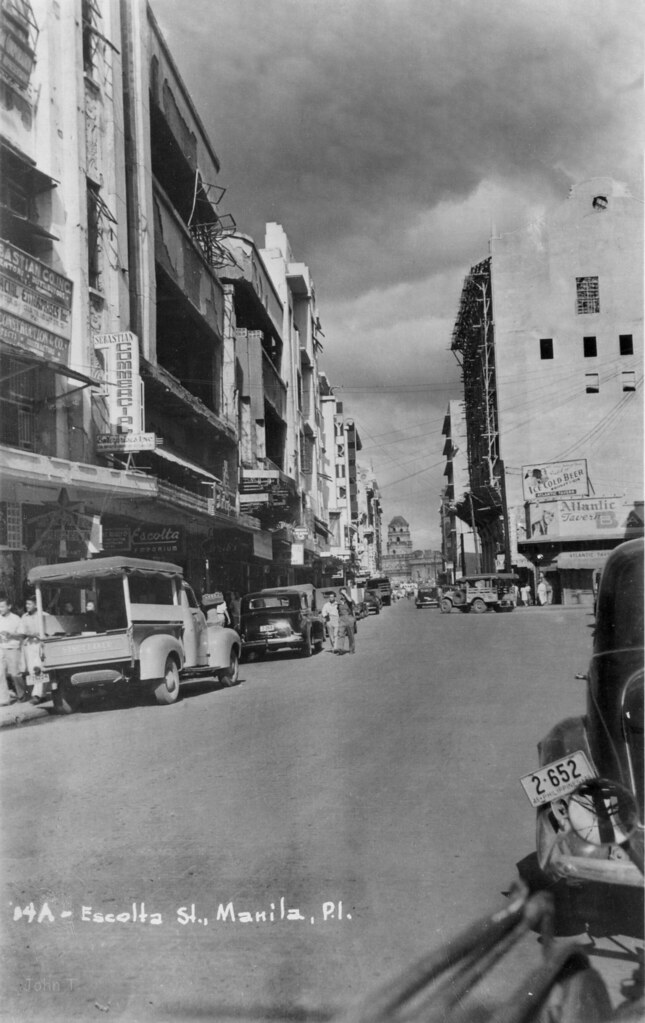

(Photographs of Manila in 1946, when independence was declared from the United States)    |

More than any country at the beginning of political independence in 1946, the Philippines was poised to become one of the most likely economic success stories in East Asia. Although it suffered immensely from World War II, no country had an instant economic recovery program readily available under sound financing.

Moreover, the Philippines had a highly educated labor force among the colonized regions in the East, the legacy of a program of universal free elementary education and a generous public health policy enforced during the colonial government. Most Filipinos had gone to elementary school at least and a large proportion of the labor force had gone to high school and beyond. Perhaps compared with any other new country, there were proportionately more literate citizens than anywhere.

“Poised for rapid recovery from war damage on the road to development.” The traditional exports of sugar and coconut oil products were assured a rich market, even though at quantitative but sizable quotas. These had been the mainstays of the nation’s export revenues before the war. Moreover, a preferential tariff access to the most economically powerful country at the beginning of the postwar period for 25 years assured the Philippines a window of growth for new exports.

What a gift in terms of market access that was! Even though this was a bilateral preferential trade agreement (meaning, American exports to the Philippines also enjoyed preferences), this arrangement was unique. No other country had that ready access to a highly industrial and economically powerful country market at the time.

It could be said that that agreement was earned at the cost of giving American citizens the same rights as Filipinos under the “restrictive economic provisions” against foreign capital in the Philippine Constitution during the 25-year adjustment period. In addition, that quid pro quo also brought in a war damage compensation program of $620 million, which was a very large sum then. (We have to multiply this by 15 to scale up to the US dollar of today.)

In addition to these, the expenditures of the US military lingered for decades in the country with the presence of military bases employing a large labor segment and procuring local goods from the Philippine economy. The initial outlays at the end of the war were sizable, adding further dollar inflows into the economy.

“We deny ourselves the golden ‘gift’.” As a new nation, our policy actions deflected us from taking advantage of the unique situation that was our great edge. We focused industrial and economic policies that distanced us from exploiting the golden ‘gift’. The measure of that denial can be assessed by looking at what our neighbors did.

They catered to the US market even without the advantages that we had in the cusp of our hands. Hong Kong, South Korea, Taiwan and Singapore did not enjoy preferential trade benefits yet they progressed by producing goods for the American market. Hong Kong and Singapore simply had free trade policy as their weapon, while South Korea and Taiwan used economic controls to favor mainly industries that exported their produce.

(A South Korean factory)

(A Taiwan factory, photograpgh by Rich J. Matheson)

We could have done the same ourselves. In fact, we had a great headstart over them which we denied ourselves through a difference in outlook. We installed import and exchange controls to promote industrialization. We devised policies to promote domestic industries producing only for the home market.

What we chose was a “narrow” path of favoring our citizens and limiting the role of foreigners. Instead of allowing foreigners as partners in enterprise, our leaders enacted rules and laws that expanded our rights while denying them the same.

The rules of exchange and import controls typified these measures. They extended the grant of investment incentives in the creation of industrial enterprises mainly to citizens. The law on retail trade nationalization that Filipinized retail trade distribution is another example. That law closed the door toward the role of foreign companies in the retail distributive trades.

“American investments decline at home.” American investments under these circumstances continued to come to the country but these were the firms that simply sold their wares to foreigners. Eventually, we would lose out in attracting more American companies with technological edge and which sought production sites for their world-wide markets that brought them cost advantages.

We encouraged mainly those American industries that produced for our own domestic market needs. Thus, we mainly had the same industries that operated in the country before the war. The country got American brands – although under much more limited means – to establish in the Philippine market.

So came in assembly industries that met domestic demand – for cars and trucks, for household appliances like refrigerators and air-conditioners, for processed foods, for personal grooming and cleaning, for medicines, and for sundry consumer items that we were used to. We continued to enjoy, through licensing arrangements, consumer goods like Coke, Pepsi, bubble gum, pop songs and others. We even imitated them to produce our own substitutes. The petroleum refining industries built the required domestic needs, but no more. We remained steadfast in clinging to American products. Hollywood continued to mesmerize us.

In return for our inward looking policies, foreign investors ceded the domestic market for Philippine enterprises to cater to and no more. Thus, the restrictions we imposed on foreign enterprises at home were matched by severe market restrictions that they gave to Philippine enterprises through licenses.

These arrangements made some Filipino industrialists rich and comfortable. They had monopoly over a wide range of the industrial market. They derived continuing profits from their licensing agreements with American enterprises. But the limited opportunities that these brought to American enterprises also made them lose interest in the limited Philippine market. They simply maintained a contented presence as the domestic economy slowly expanded.

“Our East Asian neighbors get American investments instead.” What we failed to capitalize on was what our neighbors – engaged in their own development efforts – seized upon. They had enormous labor available at low cost. They used their strengths and attracted US foreign investors to come to them.

American companies sought investment sites with low production costs and found these in South Korea, Taiwan, Hong Kong and Singapore. Later, these American companies sold or transferred their factories to reliable local sub-contractors. This was a great technological and business learning experience for these Asian neighbors.

This was how the East Asian factories produced the garments and textiles, household comforts in the home like radios, televisions, and refrigerators and kitchen utensils for the American home.

As a country, the Philippines could have exploited its advantaged position early enough. But did not through default if not neglect.

My email is: gpsicat@gmail.com. Visit this site for more information, feedback and commentary: http://econ.upd.edu.ph/gpsicat/

Moreover, the Philippines had a highly educated labor force among the colonized regions in the East, the legacy of a program of universal free elementary education and a generous public health policy enforced during the colonial government. Most Filipinos had gone to elementary school at least and a large proportion of the labor force had gone to high school and beyond. Perhaps compared with any other new country, there were proportionately more literate citizens than anywhere.

“Poised for rapid recovery from war damage on the road to development.” The traditional exports of sugar and coconut oil products were assured a rich market, even though at quantitative but sizable quotas. These had been the mainstays of the nation’s export revenues before the war. Moreover, a preferential tariff access to the most economically powerful country at the beginning of the postwar period for 25 years assured the Philippines a window of growth for new exports.

What a gift in terms of market access that was! Even though this was a bilateral preferential trade agreement (meaning, American exports to the Philippines also enjoyed preferences), this arrangement was unique. No other country had that ready access to a highly industrial and economically powerful country market at the time.

It could be said that that agreement was earned at the cost of giving American citizens the same rights as Filipinos under the “restrictive economic provisions” against foreign capital in the Philippine Constitution during the 25-year adjustment period. In addition, that quid pro quo also brought in a war damage compensation program of $620 million, which was a very large sum then. (We have to multiply this by 15 to scale up to the US dollar of today.)

In addition to these, the expenditures of the US military lingered for decades in the country with the presence of military bases employing a large labor segment and procuring local goods from the Philippine economy. The initial outlays at the end of the war were sizable, adding further dollar inflows into the economy.

“We deny ourselves the golden ‘gift’.” As a new nation, our policy actions deflected us from taking advantage of the unique situation that was our great edge. We focused industrial and economic policies that distanced us from exploiting the golden ‘gift’. The measure of that denial can be assessed by looking at what our neighbors did.

They catered to the US market even without the advantages that we had in the cusp of our hands. Hong Kong, South Korea, Taiwan and Singapore did not enjoy preferential trade benefits yet they progressed by producing goods for the American market. Hong Kong and Singapore simply had free trade policy as their weapon, while South Korea and Taiwan used economic controls to favor mainly industries that exported their produce.

(A South Korean factory)

(A Taiwan factory, photograpgh by Rich J. Matheson)

What we chose was a “narrow” path of favoring our citizens and limiting the role of foreigners. Instead of allowing foreigners as partners in enterprise, our leaders enacted rules and laws that expanded our rights while denying them the same.

The rules of exchange and import controls typified these measures. They extended the grant of investment incentives in the creation of industrial enterprises mainly to citizens. The law on retail trade nationalization that Filipinized retail trade distribution is another example. That law closed the door toward the role of foreign companies in the retail distributive trades.

“American investments decline at home.” American investments under these circumstances continued to come to the country but these were the firms that simply sold their wares to foreigners. Eventually, we would lose out in attracting more American companies with technological edge and which sought production sites for their world-wide markets that brought them cost advantages.

We encouraged mainly those American industries that produced for our own domestic market needs. Thus, we mainly had the same industries that operated in the country before the war. The country got American brands – although under much more limited means – to establish in the Philippine market.

So came in assembly industries that met domestic demand – for cars and trucks, for household appliances like refrigerators and air-conditioners, for processed foods, for personal grooming and cleaning, for medicines, and for sundry consumer items that we were used to. We continued to enjoy, through licensing arrangements, consumer goods like Coke, Pepsi, bubble gum, pop songs and others. We even imitated them to produce our own substitutes. The petroleum refining industries built the required domestic needs, but no more. We remained steadfast in clinging to American products. Hollywood continued to mesmerize us.

In return for our inward looking policies, foreign investors ceded the domestic market for Philippine enterprises to cater to and no more. Thus, the restrictions we imposed on foreign enterprises at home were matched by severe market restrictions that they gave to Philippine enterprises through licenses.

These arrangements made some Filipino industrialists rich and comfortable. They had monopoly over a wide range of the industrial market. They derived continuing profits from their licensing agreements with American enterprises. But the limited opportunities that these brought to American enterprises also made them lose interest in the limited Philippine market. They simply maintained a contented presence as the domestic economy slowly expanded.

“Our East Asian neighbors get American investments instead.” What we failed to capitalize on was what our neighbors – engaged in their own development efforts – seized upon. They had enormous labor available at low cost. They used their strengths and attracted US foreign investors to come to them.

American companies sought investment sites with low production costs and found these in South Korea, Taiwan, Hong Kong and Singapore. Later, these American companies sold or transferred their factories to reliable local sub-contractors. This was a great technological and business learning experience for these Asian neighbors.

This was how the East Asian factories produced the garments and textiles, household comforts in the home like radios, televisions, and refrigerators and kitchen utensils for the American home.

As a country, the Philippines could have exploited its advantaged position early enough. But did not through default if not neglect.

My email is: gpsicat@gmail.com. Visit this site for more information, feedback and commentary: http://econ.upd.edu.ph/gpsicat/

No comments:

Post a Comment